Errors and overpayments in health care coding and billing end up costing employers and their employees substantially—in the form of overall higher amounts for employee insurance, co-pays, and out-of-pocket costs.

One in five medical claims contain errors, which adds $15.5 billion in unnecessary administrative costs, according to a 2017 analysis by Optum. Meanwhile, 3%-7% of claims pay inaccurate amounts.

With COVID-19, those figures have grown. The already-complicated claims process became worse after COVID-19 as payers updated their systems in 2020 for conditions they didn’t anticipate.

Those updates included:

- Emerging services and new medical coding and billing procedures

- Continuous modifications to employee benefits, coverages, and cost sharing

- Increased opportunities for, and prevalence of, fraud, waste, and abuse (FWA)

Auditing claims are now more relevant than before to ensure cost controls over health plans and mitigate member overpayments.

How Disruption Affects Health Care Claims Administration

See the following breakdown of how disruption affects claims administration:

- Automated processes

- Benefits and coverage

- Claims processing

- New codes

- Benefit exceptions

- Payment rules

- Inventory spikes

Automated Processes

Claims processing systems process claims without human intervention, leveraging automation and auto-adjudication.

These systems validate member eligibility, provider network status, patient benefit coverage, and payer/provider fee schedules to properly calculate payment amounts. To function properly, the systems rely on standardized code sets, formats, and data elements to load and configure into claims processing systems.

COVID-19 disruption impacted the entire claims process from modified benefits and coverage, new diagnosis and treatment codes, and exceptions to provider network rules.

Benefits and Coverage

COVID-19 impacted claims where payers modified benefits, such as testing and expanded coverage.

Testing

The Families First Coronavirus Response Act required insurers and payers to waive cost sharing—co-pays, deductible amounts, coinsurance amounts—and prior authorization requirements for COVID-19-related testing.

These provisions were important so people could seek evaluation for exposure to COVID-19, or if they themselves had symptoms.

Expanded Coverage

Many plans expanded coverage to inpatient admissions and outpatient treatment. This meant some plans waived all out-of-pocket costs at a provider’s office, urgent care, or the emergency room through a period ending in February or March of 2021, depending on the plan.

Many plans expanded coverage for telemedicine and telehealth services related to behavioral health, specialist visits, and primary care so people could receive care while remaining safe at home.

Reconfiguring Plan Designs

The endeavor to reconfigure thousands of benefit plans took significant time and resources. It also created more opportunities for potential errors and threatened payment integrity.

Installing these changes required developing workarounds or creating makeshift manual processes for handling claims. This is an ongoing effort, especially considering the Delta variant may trigger additional work-around changes.

Poor Member Experience

There were many challenges in getting testing and treatment alone. Complicate that with erroneous provider bills, and members were unexpectedly charged for services which created negative patient and customer experiences.

Claims Processing

To add to the complexity of making changes in benefits and coverage, the different methods of testing and treatment at a medical provider made it harder to process claims and determine how much of the cost a member would actually have to share, increasing processing time.

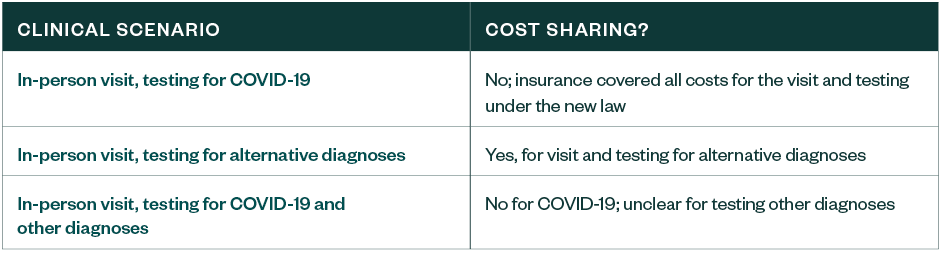

Depending on how a clinician evaluated COVID-19 and the patient’s insurance coverage, patients could have been subject to cost-sharing for the health care visit and any testing for alternative diagnoses.

A Health Affairs article published in April 2020 highlighted this challenge. When clinicians evaluated patients evaluated during in-person visits for COVID-19 exposure or symptoms, they may not have necessarily ordered COVID-19 testing.

If clinicians evaluated for other infections that had similar symptoms to COVID-19, such as influenza or pneumonia, they may have ordered testing for those diagnoses only, and not COVID-19.

When this happened, members may have had unexpected cost-sharing expenses because other tests are coded and processed differently than COVID-19 tests.

When Cost Sharing Occurs

New Codes

In addition to modifying benefits with COVID-19 as a new virus, the Centers for Disease Control and Prevention (CDC) issued a new diagnosis code and the American Medical Association (AMA) issued new procedure codes for testing and vaccines.

To process millions of COVID-19-related testing and treatment claims, payers needed to determine the capacity and timing for updating their claims processing systems to accept and process claims submitted with these new codes.

Similar to benefits coverage, payers needed to establish manual processes and workarounds as a temporary measure. Depending on the volume and complexity, some added staff to ensure manually processed claims were handled on a timely basis.

Payers that failed to establish successful workarounds floundered, and consistently paid claims incorrectly.

It’s worth noting that even though the COVID-19-tests themselves weren’t expensive, the high volumes involved significant claims dollars in aggregate. There’s also the continuing factor of member experience, which can aggravate and frustrate members who weren’t expecting to pay for these tests, especially when they’re paying, and coinsurance or copays bill, incorrectly.

New Code Sets: COVID-19 Testing and Lab Codes

The following codes are now applicable to testing and labs:

- 87635. To report infectious agent detection by nucleic acid (DNA or RNA); severe acute respiratory syndrome coronavirus 2, also known as coronavirus disease or COVID-19, and amplified probe technique.

- 87426. To report infectious agent antigen detection by immunoassay technique of SARS-CoV and SARS-CoV-2.

- 86318, 86328, and 86769. To report multiple-step antibody testing for severe acute respiratory syndrome coronavirus 2.

New Code Sets: Vaccine

The following codes now apply to vaccines:

- 91300 Pfizer. Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) vaccine, mRNA-LNP, spike protein, preservative free, 30 mcg/0.3mL dosage, diluent, reconstituted, and for intramuscular use.

- 91301 Moderna. Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) vaccine, mRNALNP, spike protein, preservative free, 100 mcg/0.5mL dosage, and for intramuscular use.

- 91302 Astrazeneca. Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (coronavirus disease [COVID-19]) vaccine, DNA, spike protein, chimpanzee adenovirus Oxford (ChAdOx1) vector, preservative free, 5x10 viral particles/0.5mL dosage, and for intramuscular use.

- 91303 Johnson & Johnson. Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (coronavirus disease [COVID-19]) vaccine, DNA, spike protein, adenovirus type 26 (Ad26) vector, preservative free, 5x1010 viral particles/0.5mL dosage, and for intramuscular use.

The vaccine codes differ by manufacturer. Also, administration codes accompany each vaccine. Different codes needed to track outcomes and results for each vaccine and administration. Implementation of the vaccine codes seemed more seamless than that of the testing codes.

However, based on a recent US Department of Health and Human Resources letter to insurers and providers from June 9, 2021, HHS Secretary Xavier Becerra underscored that, “Among other requirements, this agreement states that providers must administer COVID-19 vaccines at no out-of-pocket cost to patients. Furthermore, to ensure no surprise billing, providers may not require that patients have additional medical services to receive their COVID-19 vaccination–nor can they charge any type of fee if COVID-19 vaccination is the sole medical service provided.”

Apparently, the problems associated with the health plans and insurers providing coverage for vaccines continues.

Benefit Exceptions

In addition to modifying benefits and installing new codes, implementing certain benefit exceptions also impacted claims administration.

Plans altered how benefits applied to non-network providers for COVID-19 services. We’ve observed payers equalize out-of-pocket amounts for COVID-19 testing across both in- and non-network providers, offering the same coverage for non-network services as in-network. Many plans cover COVID-19 testing at 100% for both in- and out-of-network providers.

This represents a major concern for administrators because a provider network status is a key element in the claims cycle. If a provider’s network status is non- or out-of-network, it affects all benefits one way, and there’s less coverage to the member compared to if they’re in-network.

Complications arise when treating one benefit differently than the rest, regardless of network status, and the other benefits change depending on the network status.

It requires precision to ensure these claims process correctly, as well as system configuration or manual processes. The consequences to incorrect programming result in errors and mispayments.

Payment Rules

One change specific to inpatient claims significantly affects payers. As a result of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, inpatient claims for an individual diagnosed with COVID-19 have a 20% increase in their reimbursement.

Although this affected Medicare claims, many commercial hospital contracts base themselves on Medicare rules. To receive payment with this increase, a provider must bill a COVID-19 diagnosis on the claim

This means a patient must present with COVID-19 symptoms. After September 1, 2020, a positive lab test must also be on the patient’s medical record.

CMS indicated it would conduct post-payment reviews to confirm the presence of positive COVID-19 tests and would recover the 20% increase if it’s determined the person had no test.

If the federal government performs these tests, all lines—including commercial business, fully insured, self-insured, administrators—should meet this requirement to ensure appropriate payments.

Endless over-payment possibilities exist without proper implementation of this rule change.

Inventory Spikes

In general, changes in claims administration can disrupt transaction volumes and processing efficiency, which affects claims processing timeliness.

Under normal conditions, payers staff for a predictable volume of claims and actively manage claims inventories to achieve consistent throughput and turnaround time. The introduction of new code sets, modified benefits and coverage, changes in provider network rules, and payment rules resulted in an increase in the volume of claims requiring manual interventions and manual processing.

Overall changes in patient volume also leads to claims volume surges, claim inventory swings, and significant backlogs.

These can expose payers to potential prompt payment penalties and affect provider cash flow if there are significant delays in processing, which in turn impacts provider relations.

Payment Error Examples

Below are a few examples of payment errors resulting from COVID-19.

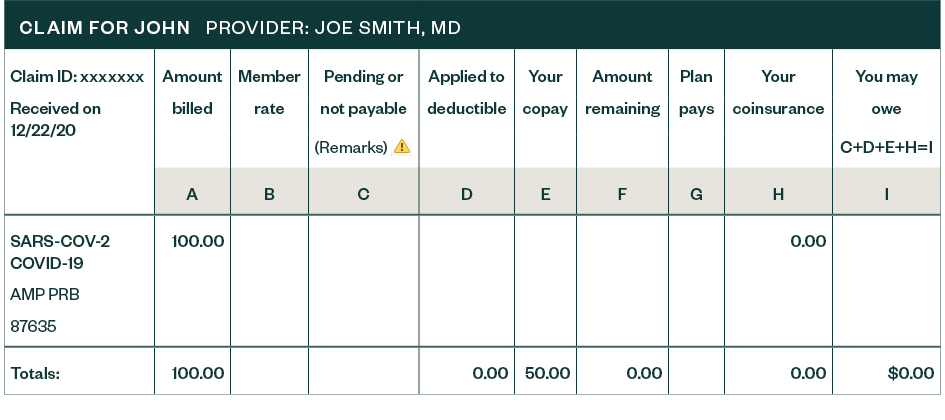

Example 1: Erroneously Charged

In this first example, the error appears straightforward.

A member came in for a COVID-19 test and was erroneously charged a $50 co-pay. The member should not have been charged a copay at all for COVID-19 testing. The payer explained the charge was made because the provider didn’t bill the claim with a COVID-19 diagnosis. This payer’s systems were built to waive only the co-pay if a COVID-19 diagnosis was present. This error highlights different ways patients receive COVID-19 evaluations and how it can affect provider billing and patient reimbursement. Keep in mind there were no regulations, payment rules, nor anything outlined in the benefit plan indicating the need for a COVID-19 diagnosis.

It’s possible that there were many other claims where the payer charged members COVID-19 tests in cases where providers didn’t also include a COVID-19 diagnosis.

Example 2: Plan Error

In another example, an incorrect calculation on an inpatient hospital claim led to a payment. The CARES Act mandates that claims with a COVID-19 diagnosis and confirmed COVID-19 test would receive a 20% increase in their reimbursement. In this example, the claim paid the 20% increase twice, resulting in an overpayment.

This was a manually processed claim. The examiner used a pricing tool to determine how much claim reimbursement the hospital received.

The claims examiner manually added a 20% increase to the pricing result to account for the CARES Act incentive. What they didn’t realize was that the pricing tool already includes the 20% increase.

In this case, the plan itself made the error. In situations where employers are self-insured, this error affects them because they hold the financial risk.

We’re Here to Help

To learn more about how to navigate COVID-19 coding and billing errors, contact your Moss Adams professional.